RAISE YOUR

AMBITIONS

It’s time to think big. Access a wide range of trading instruments, trusting in the security of a publicly traded Swiss banking and financial services group, all at attractive rates.

Access millions of opportunities and wide product range

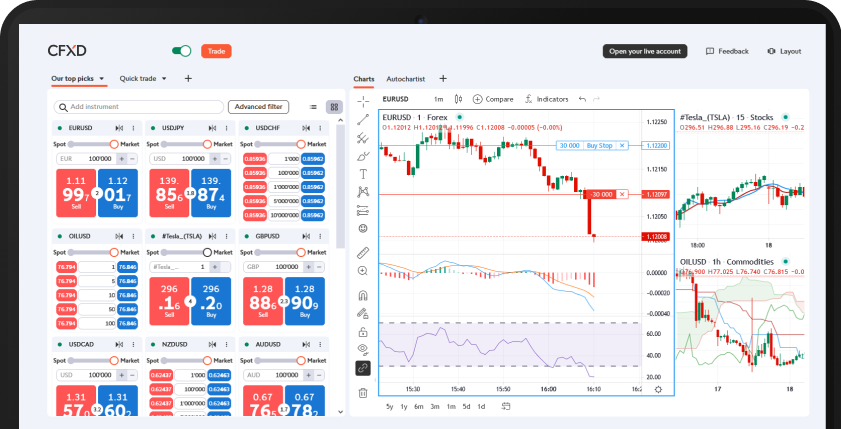

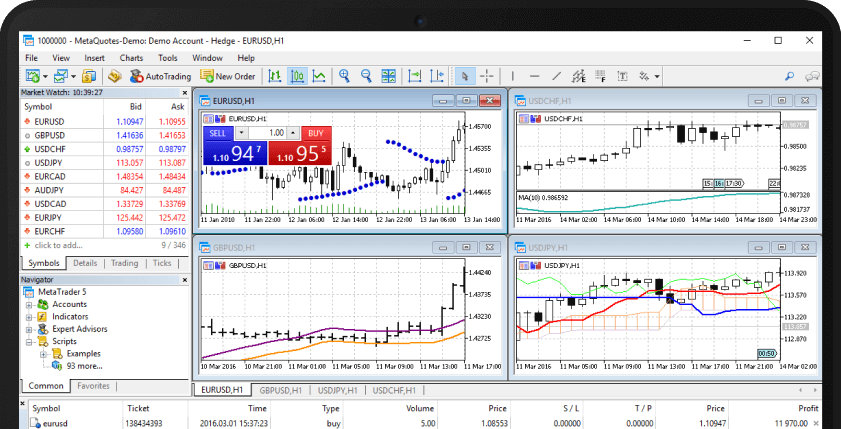

CFDs on currency pairs, precious metals, cryptos, stocks, commodities, indices, bonds: whatever your aspirations, take advantage of our competitive trading conditions, cutting-edge financial platforms and efficient tools.

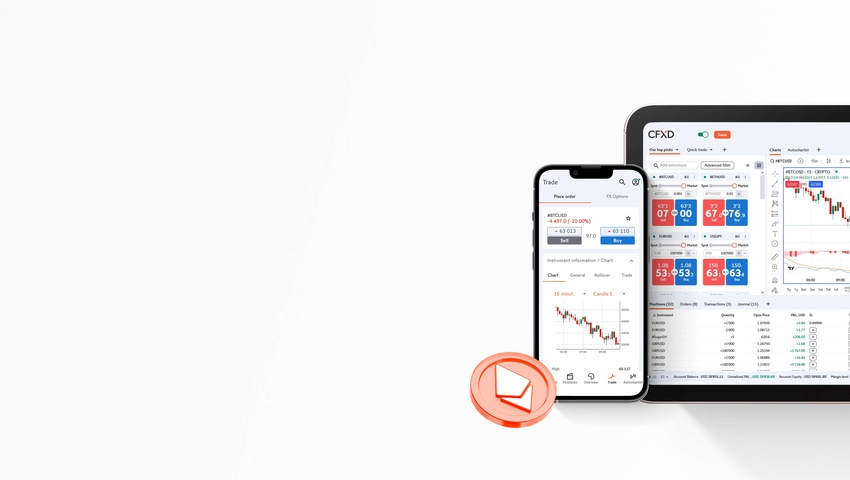

Intuitive, innovative platforms to multiply your trading potential

Swissquote: innovative, robust, different

Founded by visionary engineers, Swissquote relies on innovation to achieve success. Its mission: to democratise finance and trading to offer you unlimited opportunities.

Seize opportunities, now

Share in our expertise to boost your potential

Sharpen your knowledge thanks to our courses and eBooks, and be inspired to greater financial heights by our YouTube channel.