5.2 Measuring Risk part 1

Find out about the art of finding the right balance between opportunity and risk management by using both technical and fundamental analysis. Learn how to calculate the Risk/Profit ratio and use it to maximize profits and minimize risks.

Complete this course

Script

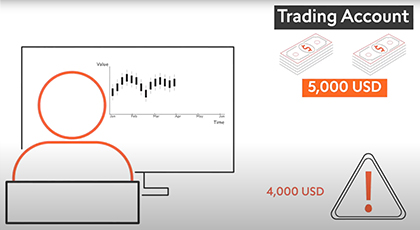

"It is said that chance favors the prepared mind. This is also true for traders, who must balance opportunity with risk management. Risk is measured in several ways. The simplest way is to define a trade size or to calculate the pip value for a given trade. Another is to note the volatility of the asset, that is, how far the price might move and how likely this is. The key is to ensure through fundamental and technical analysis that your trade is more likely to win than to lose. One key insight is that choosing winning trades does not necessarily result in overall profitability. To the contrary, traders must ensure that – on average - winning trades run longer than losing trades. In trader lingo, this is called the Profit/Loss Ratio. Generally, for trades where the price movement is presumed to be limited, like trading inside a range, a risk reward ratio of 1 to 2 is common. For trades where greater movement is expected, such as following a trend, a risk reward ratio of 1 to 3 is often used. For example, say careful analysis shows that a new upward trend is about to begin for the Euro Dollar. Given that a trend is supposed to last a while, a risk - reward ratio of 1 to 3 is a valid choice. This means that the take-profit price should be 3 times further away from the opening price than the stop-lossprice.. By ensuring that you take profits that are greater than your losses, you also reduce the ratio of how often you need to be right about a trade. In this example, the trader only needs to be right one third of the time to break even. Watch the video about Managing Risk to learn how to calculate the actual distance of the closing orders."